April 17, 2024 / Thought Leadership

The Numbers Are In: How Much of CTV Is Ad Supported?

Erin Mullaney, Media Director

For advertisers to understand today’s media consumption habits at a macro level, there are three important key metrics: reach, time spent, and ad availability. And you can’t do advertising without #3.

Yet, there’s been a massive gap in this data for Connected TV. While advertising headlines repeatedly discussed CTV growth, the reach and time spent around ad-supported CTV was nowhere to be found. So much so that the CP Media team developed our own estimations in May of last year, compiling disparate data sources to better inform our clients.

But eMarketer finally published some concrete numbers this past month – and it validated our hypothesis. So, here are four key insights to help inform your TV advertising strategy.

Want the Cliffs Notes?

Ensure your TV buys are optimized for modern day viewing. CTV has many benefits in targeting to help reduce waste. That said, you’re not reaching the masses that general streaming figures would lead you to believe. The best way to increase your reach? Buy across multiple streaming services to find the most of your audience, which programmatic can certainly help with. And don’t discount traditional TV and regular old YouTube! If you have the budget, and it makes sense for your target, there’s massive impact to be had there.

And for those looking for more…

Insight #1: While CTV Reach Is Soaring, Ad Supported Reach Is Not.

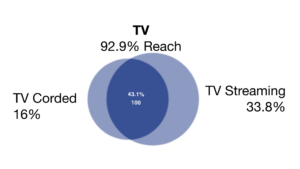

Here’s a peek at CTV versus Corded TV reach:

- TV as a whole can reach nearly 93% of the population

- 76.9% can be reached on CTV

- 59.1% can be reached on corded TV

- 43.1% can be reached on both

Source: MRI Simmons Winter 2024, A18+

While more people have CTV devices, what percent of the population can you actually reach through CTV ads? Here’s a look at the top 5 CTV subscriptions’ ad supported reach:

Source: eMarketer March 2024

Source: eMarketer March 2024

Ad supported reach is low given the top publishers have majority ad-free viewership, with the exception of Prime Video, which just switched over to ad supported in Q1. But Prime Video comes with your Amazon subscription, which gives the platform a larger reach but is less of an intentional subscription like Hulu or Netflix. This comes into play when when you look at time spent. Time with Hulu is more than double the time spent with Prime Video (eMarketer February 2024).

Insight #2: While CTV as a Whole Is Reaching More People, Broadcast & Cable Are Still Getting More Ad Supported Reach and Overall Time Spent.

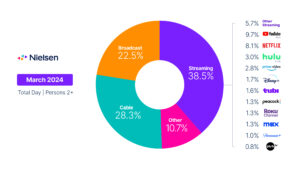

Of time spent watching TV in March, 50.8% was spent watching Broadcast & Cable vs. 38.5% Streaming. And we know the majority of time spent with Broadcast & Cable is ad supported compared to the figures we saw above with CTV.

Source: Nielsen The Gauge (March 2024)

Source: Nielsen The Gauge (March 2024)

Insight #3: Streaming Linear Is growing.

These are subscriptions that allow you to watch live broadcast & cable on your TV, but via the internet as opposed to a cord or antenna. Providers like YouTube TV, Hulu + Live, Sling, and Fubo. YouTube TV is the top provider now reaching 6.3% of the A18+ population and is forecasted to increase.

So remember when you’re buying traditional commercials, you’re also reaching these “cord cutters” through streaming linear providers. They’re included in the cable & broadcast section of the Neilsen Gauge chart above.

Insight #4: YouTube Should Be Considered in Your CTV Strategy.

We’re seeing YouTube ads being served on the big screen more and more with every campaign. And this isn’t YouTube TV, just the regular old YouTube app. We’ve seen up to 74% of our non-skippable YouTube ads served on TV devices. And if you go back to referencing the Nielsen Gauge chart, you’ll see more people are watching YouTube on their TV than any other app, even Netflix. YouTube has the most ad supported reach on CTV (53%) and should not be left out of your TV strategy.

Source: eMarketer March 2024

And if you’ve made it this far and would rather never have to keep up with this fragmented and ever-changing media landscape again, give us a call.

brief us?

brief us?